GENESIS Biomed and FI Group create GENESIS Tech Transfer Boost, a new investment vehicle that will invest in early stage projects from healthcare research

...

GENESIS Biomed is proud to announce the foundation of GENESIS Ventures,

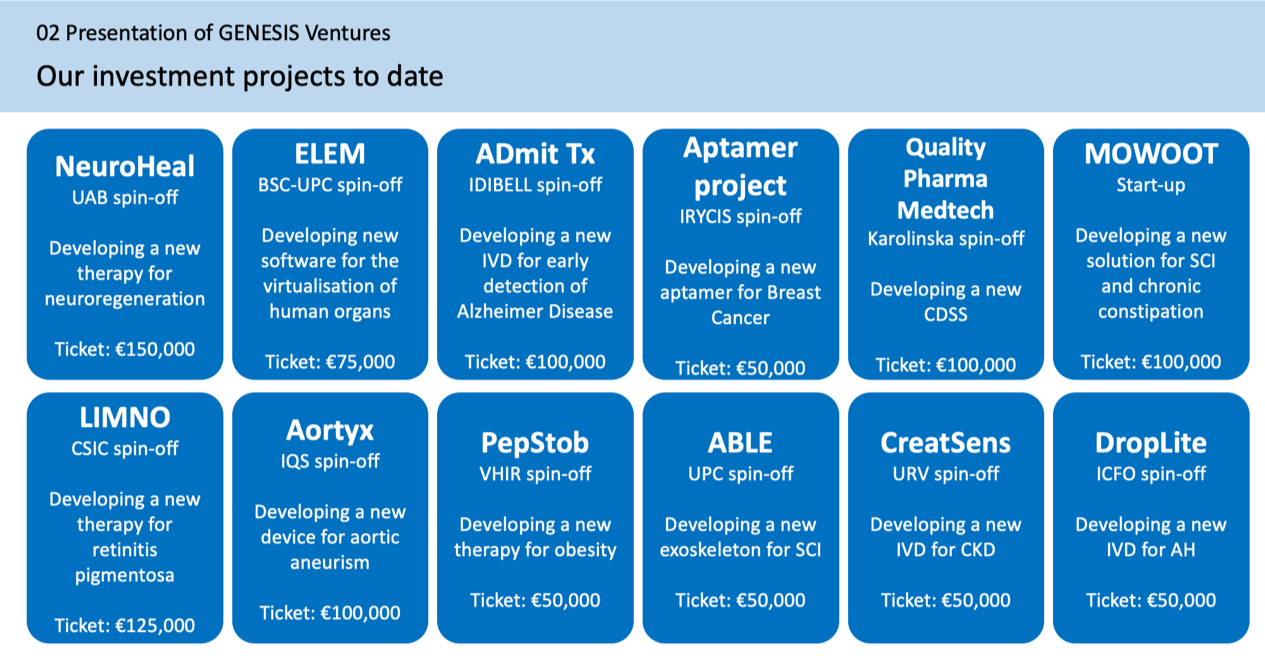

an investment vehicle based in Barcelona, investing in recently created start-ups or entrepreneurial projects in the biomedical and biotechnology field (therapeutics, diagnostics, medical devices and others) with the clear aim of developing innovative products. The society is envisaged as a very early-stage tool to help with the development of excellent scientific projects to reach key value milestones for attracting a first round of investment from venture or corporate funds.

GENESIS Ventures will fund projects or start-ups with tickets worth between €50,000 and 100,000 depending on the development needs identified. The investment period for the vehicle will end in October 2021.

GENESIS Biomed will be the company in charge of managing the fund. For more information please email to contact@genesis-biomed.com

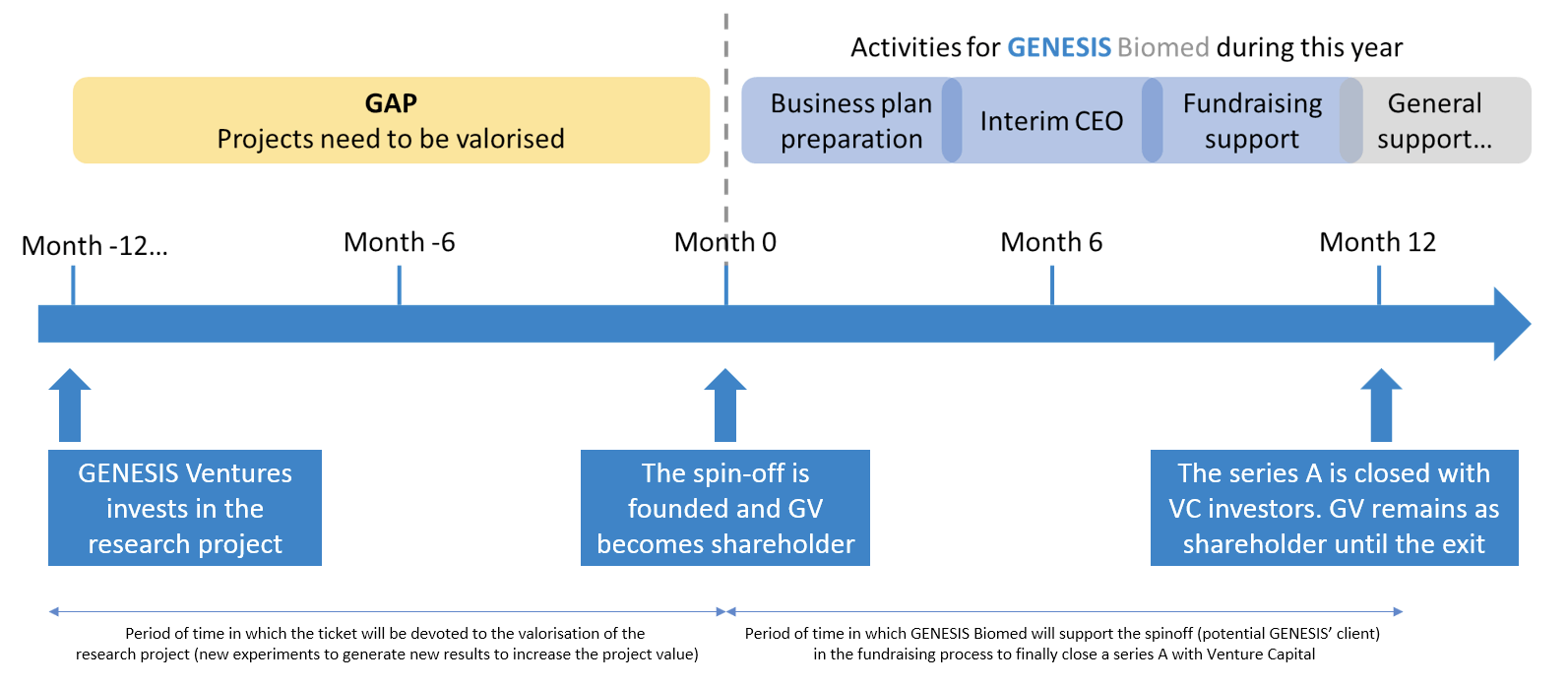

Phase 1: Pre-foundation of the spin-off

Our total fund: €2 M

Tickets*: €50,000-€100,000

An investment agreement is signed with a research centre and research group

Max. investment period*: 1 year

GENESIS Biomed will manage the projects and will inform the Investments Committee

Phase 2: Foundation of the spin-off

After the investment period, the spin-off company should be founded. If the spin-off is not founded and the project is licensed to a third party, the investment agreement governs the return for GENESIS Ventures (via upfront royalties).

On foundation, GENESIS Ventures acquires the corresponding shares as set out in the investment agreement. Our policy is not to become a major shareholder.

After foundation, GENESIS Biomed will help the new spin-off (becoming potential GENESIS’ client) in the fundraising process in order to conclude a series A with venture capital investors.

Exit scenario: the standard exit scenario for venture capital once the company is acquired or the project is licensed out to a third party.

*Guideline figures. These will be fixed in a case-by-case basis

...

Aortyx is the 1st winner of the Àlex Casta Awards....

Aortyx is the 1st winner of the Àlex Casta Awards....

Aortyx's pre-clinical studies have been successful and the team is pre...

Life sciences investors are optimistic about the future of the sector....

Having a solid scientific project and the right patent to protect it a...

ITEMAS has designed a form to evaluate the maturity of an innovation p...

Which are the needs of innovation projects born in medical centers?...

Ignasi Canals and Agnès Arbat are the entrepreneurs behind Oxolife. ...

Droplite has been joined already by Genesis Ventures –managed by Ge...

GENESIS Biomed, consultoría especializada en start-ups, emprendedores...

...

GENESIS Biomed is proud to announce the creation of GENESIS Ventures, ...