09 Jul A solid science and the right patent, keys to raise private funding

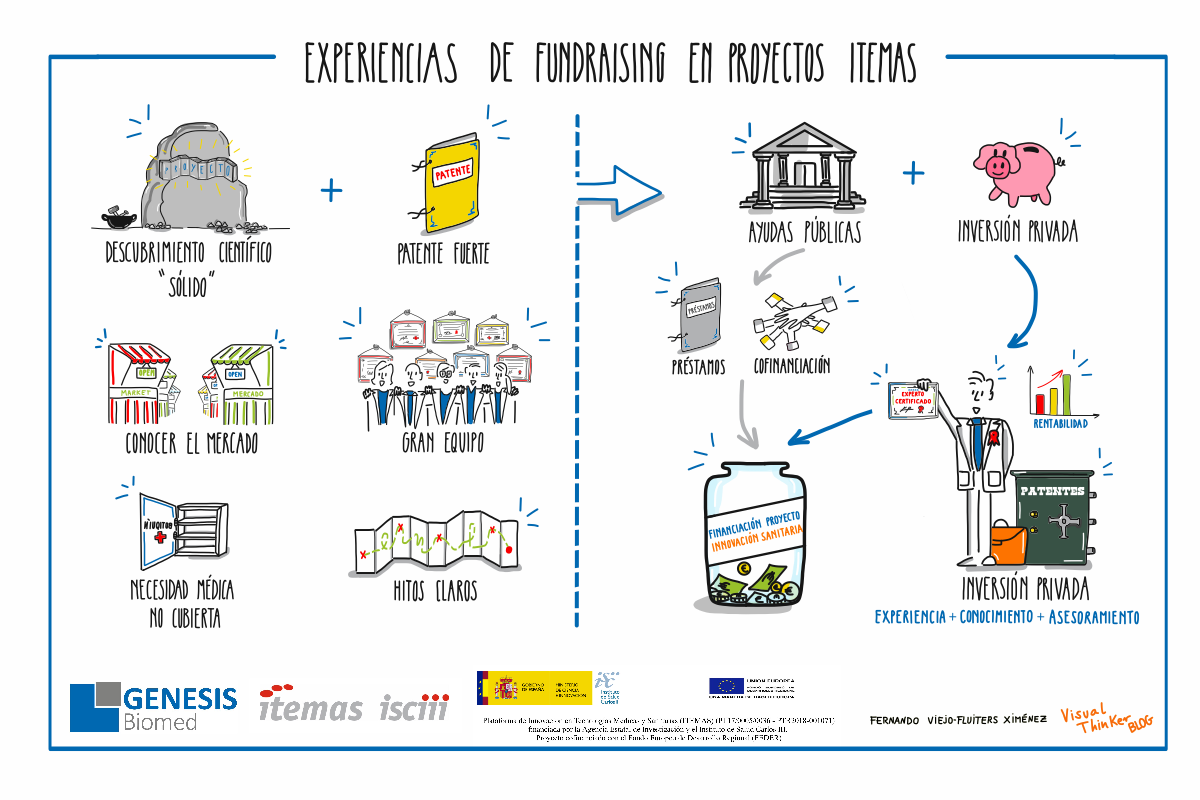

Three entrepreneurs explained the key points that helped them obtain private funding. Illustration by Fernando Viejo-Fluiters.

Having a solid scientific project and the right patent to protect it are key to raise funding in health innovation projects, according to the three entrepreneurs that participated in the 3rd webinar of the Covid-19 series organised by ITEMAS and held on July 1st. The webinar, “Fundraising experiences in ITEMAS projects” featured Corify Care CEO and co-founder Andreu Climent; GlyCardial Diagnostics CEO and co-funder Judit Cubedo and AptaTargets CFO and co-founder María Eugenia Zarabozo. The three of them highlighted that having a deep knowledge of the market a great team is also essential to attract investment.

Beatriz Pérez, Innovation Manager at Hospital Gregorio Marañon’s Healthcare Research Institute and David Arbelo, Projects Director at Madrid Parque Científico’s Foundation moderated the discussion. Here is a summary of the views and personal experience that entrepreneurs shared:

Andreu Climent, CORIFY CARE

Corify Care started its activity in 2019 with an initial capital of 300K from a local Family Office. Not long afterwards obtained 750K from an EIT Health project that facilitated the development of its technology within the AFFINE project. Recently the company obtained a CDTI (Spanish Government grant) and currently has a capital of 1,5 million and a team of six people.

This spin-off from Madrid Hospital Gregorio Marañón and Universitat Politècnica de València develops a technology that improves the detection and treatment of atrial fibrillation in a non-invasive way. Recently it opened a new investment round: “to reach market we need a a lot more money”, says Andreu. Private investment is key, not just financially: “Investors have much to contribute to a start-up. Talking to investors from the very beginning is essential as they will point the weaknesses of your project and they will help you improve”. Financing from public organisations are usually loans or co-financing so entrepreneurs “always need private funding”. For Climent it has been paramount to have “Caixa Impulse, EIT Health and GENESIS Biomed support, that have helped us a great deal along the way.”

According to Andreu, it is fundamental to prepare a good patent for your technology. The fact that their invention covers an unmet medical need has also been key to attract private investment. And also the fact that their technology solves a medical problem with a broad market, which will guarantee its profitability. Finally, he advises entrepreneurs to have clear milestones and to raise funding for each of them. “We are convinced -says Andreu- that in ten years we will succeed. We are just beginning our journey.”

Judit Cubedo, GLYCARDIAL

GlyCardial Diagnostics is a spin-off from Barcelona Hospital de la Santa Creu i Sant Pau and the CSIC (Spanish National Research Council). Founded in 2017 with an investment of 2,4 million from Caixa Capital Risc and Health Equity, it develops a novel in vitro diagnostic device for myocardial ischemia based on the detection in blood of Apo J-Glyc biomarker. One year after its foundation, the company raised 2,6 million of public financing (SME Instrument, EIT Health and other grants). Currently is working in the clinical validation of its solution.

Judit Cubedo says they have not a defined strategy for raising funds, “we knock on the doors of many investors as we need lots of money to carry on”. “Having a solid scientific project was decisive to raise a high initial investment and also the fact that our technology covers an unmet medical need”, says Judit. Unfortunately investors tend to back therapies more than diagnostic devices, “a trend that should change if we want to shift from a healthcare focused on treatment to one focused on prevention”. For Cubedo it is essential to contact investors specialised in health and to have competent advise from the beginning. “Counting with GENESIS Biomed from the beginning was key to be able to take the right decisions”. Just like Andreu Climent, she thinks that “it is vital to have the right patent for your project.”

María Eugenia Zarabozo, APTATARGETS

Founded in 2014 with 200K investment, AptaTargets is a biopharmaceutical company focused on developing therapies based on aptamers. Its technology arose from Aptus Biotech and IRYCIS (Instituto Ramón y Cajal de Investigación Sanitaria), with the collaboration of the Neurovascular Research Unit at Madrid Universidad Complutense. In 2017 closed an investment round leaded by Caixa Capital Risc and the participation of capital risk fund Inveready, with the goal to start a clinical trial. Currently it has successfully completed its first phase 1 clinical trial in healthy volunteers and it intends to start its efficacy phase 1b/2 in acute stroke patients in September.

María Eugenia Zarabozo agrees with Climent and Cubedo that the search for funding is continuous for entrepreneurs and also highlights the importance of the “travel companions”. It is also paramount that investors are healthcare specialists: “We were very lucky with Caixa Capital Risc and Inveready, being able to count on their knowledge and experience has been fundamental”. In the short term they expect to close a new investment round and to formalise collaboration agreements with pharmaceutical companies: “when the company has advanced in the clinical development of ApTOLL and has some preliminary results in patients.”

The not so negative impact of Covid-19

The three entrepreneurs agree that Covid-19 pandemic has not affected them dramatically. On the contrary, Zarabozo believes that “the lockdown has been positive in the way that we have been able to meet some deadlines. The crisis has also prompted the opening of new financing instruments in the public sector”. Cubedo admits that Covid-19 “touched us at a critical moment and our clinical study had to be postponed. However we have seen an increasing interest by investors. Rounds are closed with higher amounts to guarantee the feasibility of projects”. Climent agrees: “once the worse of the crisis has passed, we have noticed that investors are even more interested.”

Next webinar: “Impacto de la Covid-19 en la inversión privada y corporativa”

*Related news: The keys to raise private funding: evaluation of an innovation project