09 Nov Value-based medicine and Risk Sharing Agreement

Over the last 20 years, we have witnessed major advances in biotechnology and synthetic biology that are likely to result in the emergence of new therapeutic treatments for diseases that until recently were either poorly resolved or had no solution at all.

The advance of cellular therapies is an example of this, where therapies such as Yescarta or Kymriah, which consists in the treatment of lymphocytic cells extracted from the patient, genetically manipulated to express a receptor capable of recognising certain antigens present in the tumour cells and then introduced again so they are capable of recognising them and destroying the tumour cells, have managed to eradicate the disease in a significant percentage. But these treatments are often very expensive. For example, Yescarta’s treatment in Spanish public hospitals for a child with leukaemia costs 307,200 € (Source: Civio 2019), and these treatments in other countries can cost up to 475.000 $.

Therefore, in the case of innovative drugs, especially in the field of oncology, due to the high cost of these treatments for public health systems, there is a need to ensure a better budgetary control, in which the risk of spending on certain high-cost drugs is subject to the clinical benefit in the population to which they are applied. Payers, such as health insurance companies, patients, governments, supervisory agencies or others, are beginning to decide based on a new concept of “Patient Value” which is defined numerically as the outcomes that matter to patients “Health Outcomes”, such as functional recovery and quality of life, divided by the cost to achieve these outcomes.

Patient Value= Health Outcomes/Cost

This definition was introduced by Michael Porter and Elizabeth Teisberg in their book Redefining Health Care, a work that launched Value-Based Health Care as a new framework for structuring health care systems with Patient Value as the final objective.

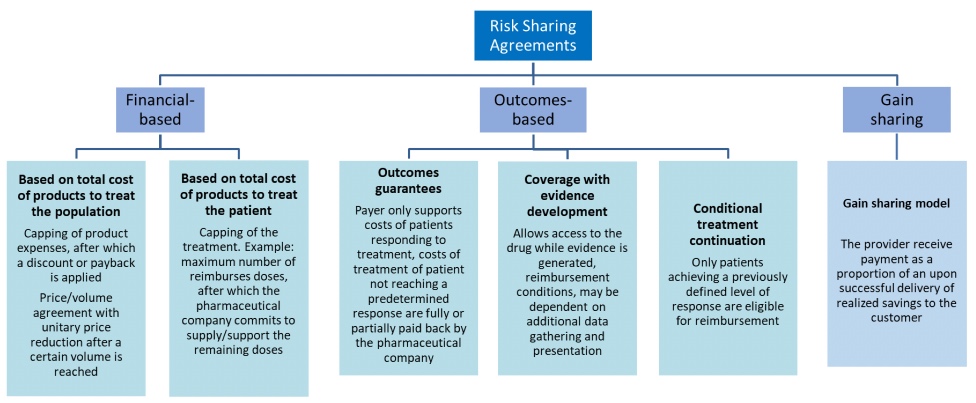

This has led to innovate in flexible and personalised reimbursement systems that align the prices of drugs with the value they bring to the patient, “Patient Value”, and one of these models is what has come to be known as a Risk Sharing Agreement (RSA). RSA is defined by HTAi (Health Technology Assessment International) as an agreement between the producer/manufacturer and the payer/provider that allows access (coverage/reimbursement) of a healthcare technology under certain conditions. These agreements can use a variety of mechanisms to address the uncertainty and can be categorized into two broad groups:

(a) financial agreements, where cost containment is defined simply on the basis of the price of the drug or the cost of the treatment.

(b) Agreements based on clinical outcomes, i.e., payment is based on a series of results or outcomes in real clinical practice. In this way, the National Health System only pays for the treatment if it works or at least works at a percentage in which the cost-benefit makes sense and is socially/economically profitable (lack of productivity of the affected personnel, etc.).

Below are some options in this type of agreement:

Gonçalves F.R. et al, Risk-sharing agreements, present and future. Ecancermedicalscience 20

This RSA system is also profitable for the pharmaceutical company because it allows more national healthcare systems to take the risk of incorporating innovative and expensive treatments, thus increasing their market share. In essence, it is a system that is intended to be a win-to-win.

But in RSA reimbursement systems based on clinical outcomes (group b) it is necessary to be able to rely on measurable clinical indicators on which to base this negotiation between the pharmaceutical company and the public health systems. This is where the difficulty of this business model arises, in finding measurable and clear outcomes that can be quantified and accepted by both parties without inducing subjective interpretations or a lack of transparency in the information provided.

An example of this type of model can be seen in the negotiation between the Spanish Ministry of Health and the pharmaceutical company Gilead regarding the drug Sofosbuvir for the treatment of hepatitis C. The initial treatment had a cost of approximately €70,000 per patient, which was reduced to around €25,000, in addition to another part of the therapy per patient, but in any case, due to its high cost, it was only prescribed for patients in severe and critical situations. The general protest from patients requesting that the drug reach a larger number of patients led the pharmaceutical company and the Spanish government to continue negotiating. However, negotiations of this type with governments are characterized by opacity because their publication may subordinate negotiations with other countries with which they have reached different agreements that may be more beneficial to the pharmaceutical company. It should also be considered that in the case of drugs that cure the patient, the pharmaceutical company considers that its revenues must be higher, since it loses the loyalty of a chronic patient whom it cures and who will stop using the drug. This and other factors are taken into account in this business model. Therefore, despite the high cost of direct-acting antivirals and the fact that the exact price of the agreement has not been unveiled, hepatitis C treatment is considered profitable. Especially because the cost of treatment is compensated by savings in health care costs due to the reduced use of national health care system resources.

As previously mentioned, the development of more sophisticated and high-cost treatments with a high preponderance of advanced therapies suggests that this business model is expected to be imposed in more and more cases, implying a paradigm shift in the pricing agreed between payers and pharmaceutical companies.