14 Jul Negotiating a Round in the health sector

Article by Josep Lluís Falcó – Founder and CEO of GENESIS Biomed

Dialogue with investors is no easy task for entrepreneurs in the healthcare sector. We will focus more on how to negotiate a round in the health Venture Capital investor sector in this article, and in the second article to be published later we will focus on early – mid stage rounds. Other types of investors, and other types of rounds, have different characteristics that mean that some of the advice given here may not be entirely accurate. And of course, sectors other than the health sector may have nothing to do with it.

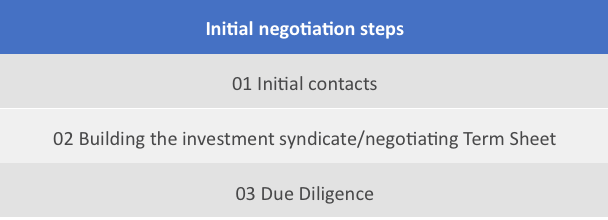

This first article will focus on the phase prior to the start of the negotiation phase with investors. Indeed, we are talking about a relatively long period for which we must be prepared. We must differentiate between three main phases in terms of dialogue with investors. We are talking about between 6 and 12 months in total:

- The initial contacts phase or roadshow (2-6 months), in which we will have to spend a lot of time, resources and energy in visiting one by one all the investors that may be plausible for our investment round.

- The phase of building the investment syndicate and negotiating the Term Sheet (2-3 months), in which we will have to put all the necessary ingredients so that a group of investors, to whom the project has fitted in the previous phase, agree to send us an investment proposal that we will have to negotiate with them.

- The Due Diligence phase and closing of the round (2-3 months), in which we will be examined and audited in each and every aspect of our company and we will be presented with a complete investment contract, which we will have to negotiate properly.

Once we have focused on the time frame and the phases ahead of us, we must realise that before starting any contact with investors there is a preliminary phase to all of this: the preparation of our company’s business plan and the preparation of the financing strategy. Without this, it is not at all advisable to see investors, since the image we can give may be highly damaged for the future, and all the inaccuracies that will occur will only turn into a bad deal for us, if we get there at all.

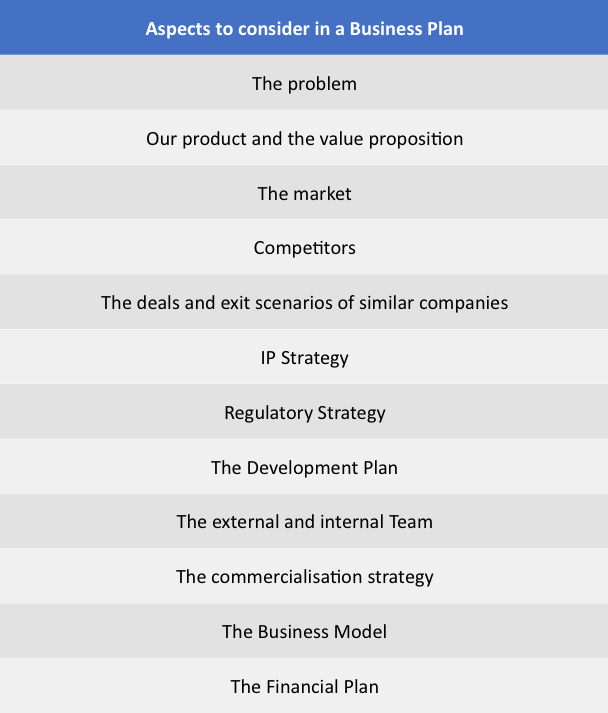

In order to carry out a good business plan it is highly recommended to surround yourself with a good consulting firm that will help in all or at least some of the key aspects of a professional business plan. In this, we must take into account aspects such as:

- The definition of the problem that our product is going to solve. What is the pain present in the current clinical practice, and what are the points for improvement. What is the current patient journey.

- What is our product and what are its advantages and value proposition. What are the main proof-of-concept results we have collected in the past.

- The size of the market and market segments we will target. Describe incidences, prevalence, and what are the barriers and opportunities of this market. Geographic segmentation is essential.

- Who are our competitors who are already in the market and who will be our future competitors who, like us, are in the market today.

- Map the comparable deals to the ones we intend to sign, in order to have a battery of similar investment deals that will allow us to see which investors are behind them, the size of the rounds, the use of funds and valuations.

- Having a mapping of the exit scenarios that our reference competitors have been able to achieve, as this information is vital to make sense of the life cycle of our company and to fit and be aligned with the business model of a Venture Capital. As my best friend Alex, God rest his soul, used to say: “Show me the exit!

- Explain in detail the company’s IP strategy and how we protect our technology and the projects in our portfolio. See how this technology has been transferred to our spinoff or startup from the Institution(s).

- Describe the regulatory strategy that will mark the preclinical and clinical development plan for our product. Whatever we are (a medical device, a diagnostic kit, a treatment, a digital product, etc.) any product will always be subject to a regulatory framework that will oblige us to develop the product in one way or another. At the very least, we will have to study European and North American regulations. The development plan will be very much defined by the regulatory strategy and will have to be precisely defined in terms of time and economic costs, as it will be one of the most important sources of expenses and will have to cover the investment round that we intend to close.

- It will be advisable to validate this regulatory strategy through a briefing meeting with a regulatory agency or a Notified body, this will lend a great deal of credibility to the business plan and the investor’s perception will be optimal.

- Detail the current entrepreneurial team that will drive the project forward, and describe what the incremental evolution of the future team will be, as today many of the roles necessary for the successful development of the product and the company may not be in the company. Having a full time CEO, as a minimum starting requirement, is indispensable.

- Identify the people outside the company who may play a very important role in the future: the Chairman of the future Board of Directors, or the KOLs who will make up the Scientific Advisory Board.

- Sizing the marketing strategy and the business model that our product (and/or service) is going to follow, and the pricing strategy. To do so, this marketing strategy must be aligned with the product development and market access strategy, achieving a minimum level of sales (at research use only level) before obtaining approval, especially in the case of health tech, while subsequently sizing the local sales force that the company can achieve, in order to reach target sales, before a potential acquisition by a multinational company that causes the exit of investors.

- Take into account both the private and public market for market access, and especially in the latter, the innovative public procurement mechanisms that we can find at our disposal. A minimum cost-effectiveness study is highly recommended for our business plan.

- Finally, translate all the costs of personnel, development, operations, etc. into a complete financial plan that indicates the total cash need of our product and allows us to divide the different rounds of investment that we are going to follow. In addition, we must have the valuation of the company, properly calculated according to financial methodologies such as discounted cash flow, the comparable method or the investor’s method.

All this, accompanied by a deck with the most representative slides to start the roadshow, will allow us to face with guarantees the success of the journey we will undertake in the negotiation of our investment round with Venture Capital.

These lines are written from the experience accumulated in GENESIS Biomed, having closed 18 investment rounds in the last 5 years, and having raised more than 65 million euros for our clients. Strategic consultancies like us play an essential role in the biomedical innovation sector, as we act as a facilitator and support element for our clients, entrepreneurs and institutions in the sector.

The second opinion article, which we will publish in September, will focus on how we face the three phases mentioned above and which can lead us to the closing of the investment round. We encourage you to stay tuned for the second article we will publish, where we will provide useful tips for health entrepreneurs.