02 Jul How to raise private funding: evaluation of an innovation project

ITEMAS has designed an instrument to evaluate if an innovation project is mature enough to be presented to an investor.

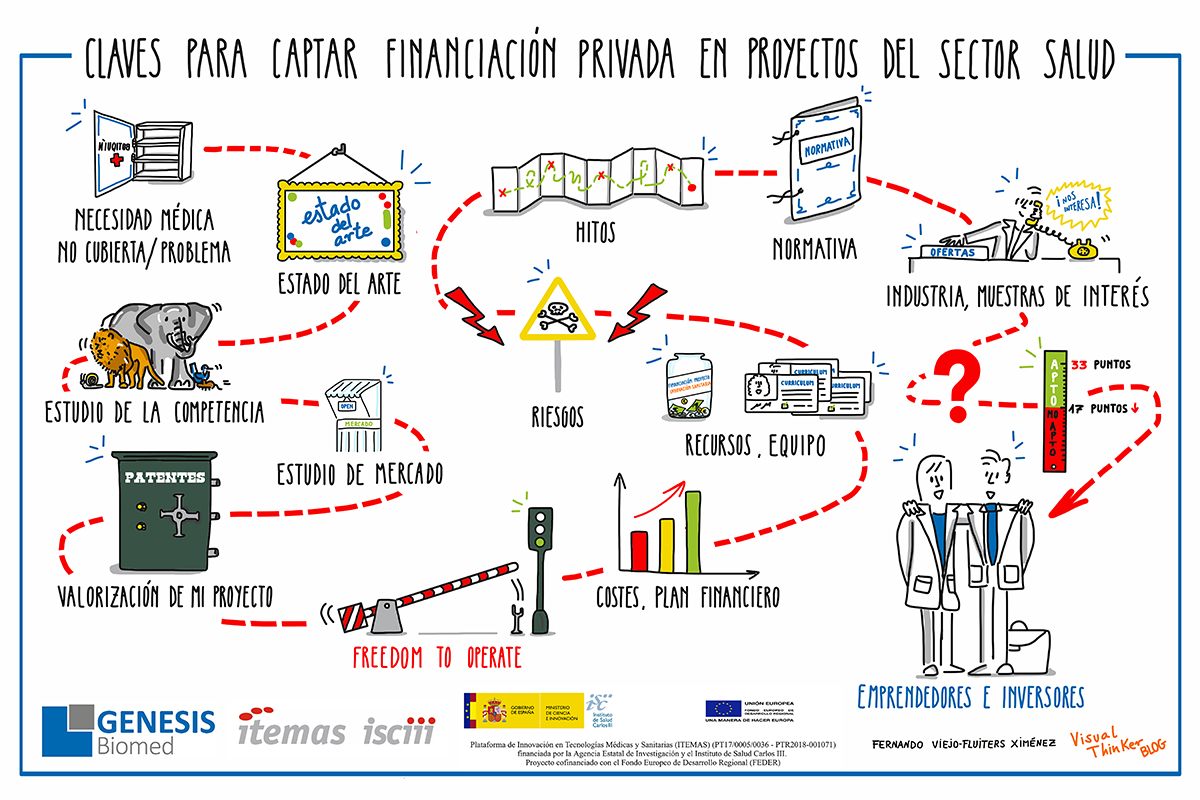

Raising private funding is essential for an innovation project to progress and reach market. ITEMAS 2nd webinar of the series about Investment in Covid-19 times tackled the key steps for entrepreneurs to be able to achieve a mature project in order to obtain the necessary funding to go ahead with their project.

ITEMAS working group Métodos de Evaluación, inside the Empresas e Inversores section, has designed an instrument to evaluate innovation projects and determine whether the project has the necessary maturity to obtain investment. Estela Sánchez, member of this group and Innovation Manager at Instituto de Investigación del Hospital Univesitario La Paz (IDIPAZ), explained the main concepts included in this instrument and how they punctuate.

It is an evaluation form that takes into account the phase in which the project is currently immersed and that evaluates the following aspects:

- Need/Problem

- State of the Art

- Competencia

- Mercado

- Valorización del proyecto

- Costes

- Recursos

- Riesgos

- Hitos

- Normativa

- Industria

Compliance of the different aspects adds points to the project. The maximum number of points is 33 (when a project complies with all aspects) with the minimum number of points for a project to be presented to investors is 17. On ITEMAS website you can find the form for evaluation of innovation projects and the instruction sheet

on how to rate the information included in the form. Projects that do not achieve 17 points are considered “not suitable to be presented to an investor” and they will need further work.

Juan Solís, partner at Arvor Global Management pointed that “there are three key factors for an innovation project to obtain funding: an existent market need, a good business model and a solid team. All these points are key for investors”. It is also imperative to take into account in which sector of healthcare sector is the project included as it is not the same a medical device that a pharmacological therapy.

Raúl Martín-Ruiz, partner at capital risk firm Ysios Capital, said that is fundamental for entrepreneurs to have an extensive analysis of their future competition, “an important point that entrepreneurs tend to minimise and that is terribly important for the new company”.

The instrument designed by ITEMAS gives extra punctuation to some key points, for example, meeting a clear need in the market and having scientific evidence for the solution; having a freedom to operate report, a patent protection and a development plan. These concepts get double points as they are considered strategic to the progression of the project.

The speakers at the webinar also highlighted the importance of adapting to the investor needs: “sometimes the interests of the institution’ government body are very distant from those of the investment company”, said Raúl Martín-Ruiz.

More info on the next webinars.

*Related news: “ITEMAS is in favour of the creation of a fund or investment instrument for early stage projects”